By now, you’ve heard the good news. President Joe Biden has announced a plan to forgive $10,000 (and in some cases up to $20,000) in student loan debt for borrowers who make less than $125,000 a year.

That’s a lot of math we just threw at you, and here’s some more: around 44 million Americans have student loan debt, and many of them owe a jaw-dropping amount. The average student loan balance is a whopping $37,667, so taking $10,000 off the top is barely going to make a dent.

If you still have a heavy albatross of student loan debt hanging around your neck, it sucks, but don’t despair. There are plenty of things a college graduate can do to help pay off student loan debt in a manageable way.

For those still in school, and who have no hope of forgiveness (bleak but true), there are still ways to make continuing education more affordable in the first place.

Here are several Mandatory-approved options to choose from when paying off your student loan debt.

Cover Photo: Catherine Lane (Getty Images)

1. Refinance your student loans.

There are several benefits to refinancing your student loans. You may have taken out a student loan with a considerably high interest rate and may want to refinance your loan to lower the interest rate, which could lead to a lower monthly payment.

Perhaps you want to consolidate your loans and bundle all of the loans up into one monthly payment. This can relieve stress, as all of the bills are in one place.

By refinancing student loans, the borrower has the option to have a more flexible budget in their everyday life, instead of not having much wiggle room to pay for other bills in their budget. Refinancing student loans is not for everyone, but can be beneficial for those who need help lowering monthly payments.

2. Make early payments to unsubsidized loans.

If possible, make early payments to unsubsidized loans while you’re still in school.

Unsubsidized and subsidized loans are vastly different. The key difference between the two loans is that unsubsidized loans start charging interest immediately. Subsidized loans do not accrue interest while you’re in school or during deferment periods.

If your unsubsidized loans are fully paid off, make extra payments to the other student loans you have borrowed.

Create a budget to help make early payments. Find ways to spend less money and see if there are ways to lower your bills. Instead of spending on things you don’t necessarily need, put that money toward your student loan debt. An extra $100 a month can potentially lead to saving a lot of money in accrued interest.

3. Attend community college.

Attending a local community college can decrease overall tuition costs.

Before you enroll in a university, take all of the required general education courses at a community college. The savings of this can potentially be thousands, which will save you plenty of time and money once you’re graduated.

Not only that, you’re essentially getting the same education you would receive at a university, only for a fraction of the cost. And since most universities only require 60 college credits completed at the actual university for graduation, you may have the option of completing two years’ worth of courses at a community college instead.

4. Educate yourself on how financial aid works.

Unfortunately, many college students and graduates are not fully aware of the ins and outs of financial aid and the interest that can accrue while in school.

Learning how student loans work, especially before enrolling in college can be tremendously helpful. Reaching out to a financial aid counselor at a high school or college can help you make better decisions when it comes to accepting financial aid.

5. Do not take out 100 percent of the aid awarded to you.

Often, students will accept 100 percent of the financial aid awarded to them even if it is not needed. Meet with a financial aid counselor to calculate how much you will need to attend college.

Many students get offered way more financial aid than is necessary, leading the student on a much longer journey of paying off their debt. By taking out only what is necessary, overall student loan debt will decrease, making paying the debt off much quicker.

6. Take out private student loans only as a last resort.

Private student loans should only be taken out once all other options are exhausted. Before taking out private loans, look into applying for scholarships or grants. Many students feel intimidated or overwhelmed by applying for scholarships and opt to avoid applying for them altogether. There are thousands of scholarships college students can apply for that will relieve the overall debt after graduation, which makes it very important to at least try to get a scholarship.

7. Start a side hustle.

If you have the availability, consider starting a side hustle to pay off your student loans more quickly. This extra money can be put towards your student loan debt and make the overall payment process plenty less stressful.

And, before you think you don’t have enough time for a side-hustle, consider this: the average person spends over 30 hours a week sitting in front of the TV. That is time that could be better spent!

Student loans can seem overwhelming and intimidating at first, but there are many things you can do to lower the overall debt. You have the options of refinancing your student loans, attending a community college instead of enrolling straight into a university, making early payments, and so on.

Staying educated and on top of financial aid and student loan debt is a crucial part of paying off student loan debt. The more you know, the better.

Entertainment News 8 15 22

-

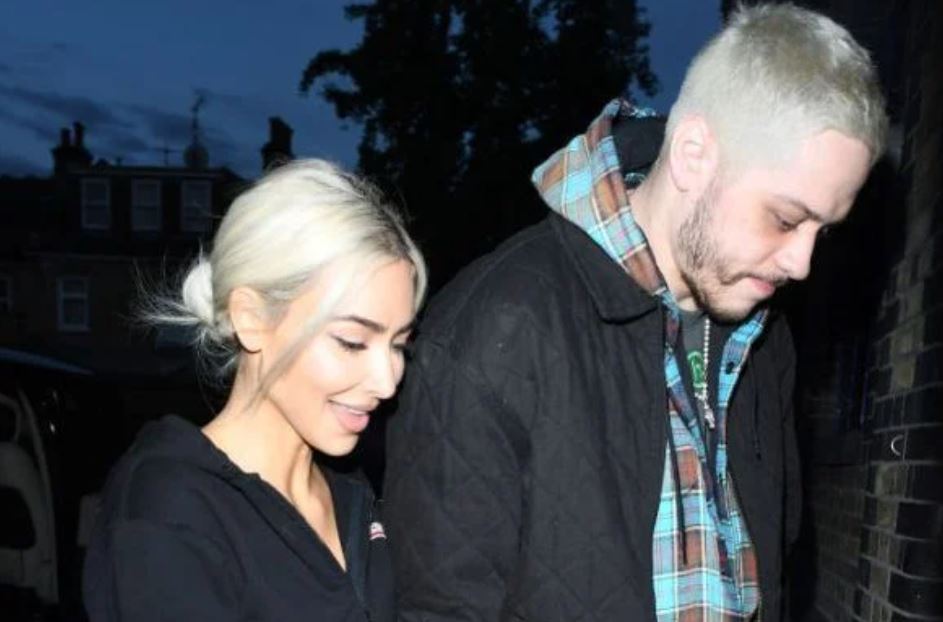

Kim Kardashian and Pete Davidson Call It Quits After 9 Months (Here Are the Best Pics From the Oddest Rebound Relationship Ever)

Read more here.

Photo: Getty Images

-

New Keanu Reeves Series ‘Devil in the White City’ Coming to Hulu (Here’s Everything We Know So Far)

Read more here.

Photo: Getty Images

-

Conor McGregor Joins Cast of Prime Video’s ‘Road House’ With Jake Gyllenhaal (We Can’t Wait For the Fight Scenes)

Read more here.

Photo: Getty Images

-

Timothée Chalamet Is a Lovestruck Cannibal in ‘Bones and All’ (Whet Your Palate With This Trailer)

Read more here.

Photo: Metro Goldwyn Mayer Pictures

-

Woody Harrelson Responds to Viral Baby Look-Alike (And Admits He Envies This 1 Thing)

Read more here.

Photo: Twitter

-

Actor Ezra Miller Accused of Stealing Alcohol From Vermont Home (So Much For Those Superpowers)

Read more here.

Photo: Warner Bros.

-

Kanye West Celebrates Kim Kardashian and Pete Davidson Breakup With Photoshopped Obituary (As One Does)

Read more here.

Photo: Getty Images

-

Mindy Kaling Finally Addresses Rumors That ‘The Office’ Co-Star B.J. Novak Is Her Baby Daddy

Read more here.

Photo: NBC

-

10 Overlooked Superheroes Who Deserve Their Own Movies

Read more here.

Photo: Marvel

-

Ranked! Under-the-Radar Superhero Movies (Including Sylvester Stallone’s ‘Samaritan’)

Read more here.

Photo: Amazon Studios